Ways to Make a Major Impact

Get in Touch with Our Team!

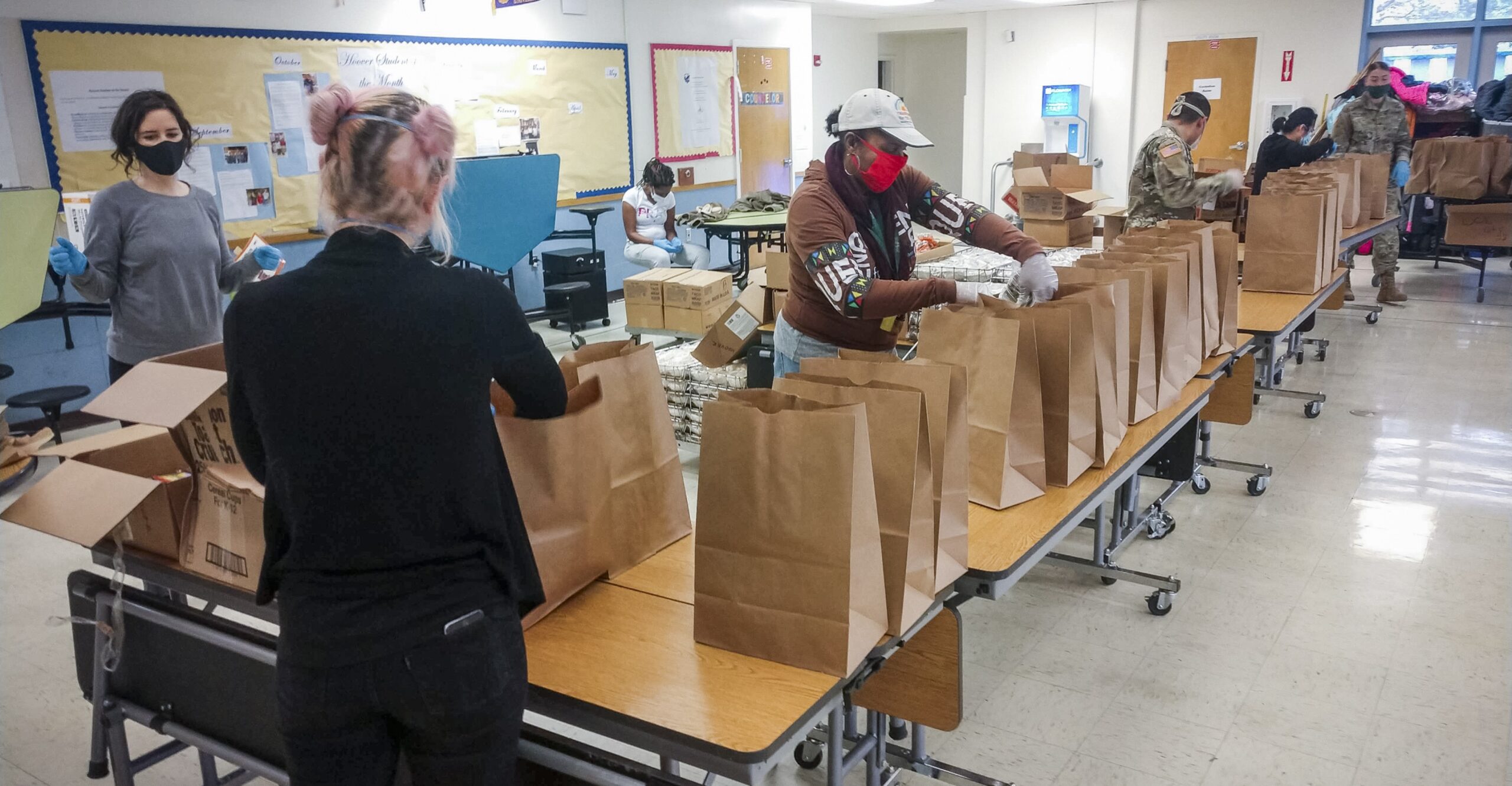

Contact us directly to learn more about how to help give millions of kids the healthy food they need and deserve.

The Impact of Your Giving

$1,200

could provide 12,000 meals

for a child who is struggling with an empty belly and demoralizing hunger pangs.

$12,000

could help communities

provide kids with free, local after school and summer food programs.

$65,000

could help provide grants

to schools and community groups across the country so they can afford what they need to feed kids.

*Please note that these examples are for illustration purposes only and actual gift amounts may differ. Please contact our team to see the impact you can make possible.

Become a No Kid Hungry Insider

Do you want to receive exclusive email updates directly from No Kid Hungry?

Get direct and instant access to a member of our team, who will share information about your impact, project outcomes and stories from the field.